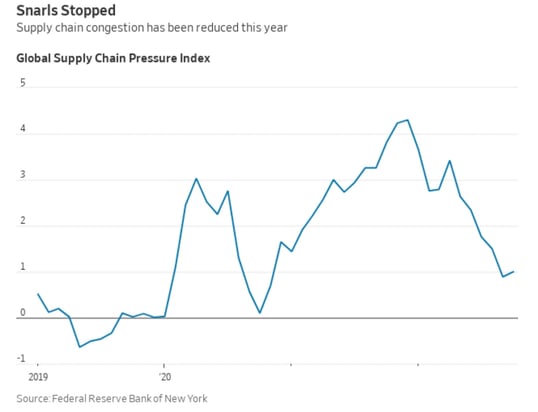

Container imports to US ports have dropped. West coast imports were down 26% in October. As labor issues out west push containers to more stable labor pools in gulf and east coast ports, the average price per container from Asia to the US settles around $3,200 per FEU (forty-foot equivalent unit). Just three months prior we were seeing $8,500 per container. Things are different this year with this 62% drop in container price from August to November (Peak Season). We find a few interesting points when digging deeper to see what this can mean for our clients.

Consumers are pulling back now

After several rate hikes this year, consumers were standing strong. October revealed a different story with consumers taking a step back from spending. According to researchers at the Conference Board Consumer confidence dropped with 17.5% of consumers saying business conditions were “good,” down from 20.7% of consumers the month prior. This sharp drop coupled with falling container rates points to transportation demand coming back to equilibrium.

There is building inventory

With consumers less certain about how far their dollars will go and the massive manufacturing push over the last 6 - 8 months we are starting to see warehousing and distribution questions come over the bow. With the memory of not getting products to consumers fresh in the manufacturer’s minds, the next best option is to hold what you have for as long as it makes sense, then everything goes on sale. This macroeconomic pendulum swing is unavoidable, and we see it coming in the consumer retail space. Our first thought was warehousing rates might tick up at an even quicker pace, but from what we see, warehouse rates are starting to cool off. WSJ reports distribution space is tight, but vacancy rates ticked up ever so slightly in September 2022 for the first time since 2019.

Get creative

As is often the case, what to do depends on what goods you are manufacturing, shipping, and stocking. If you have overstocked or overproduced in preparation for the busy holiday season, here are some rules we use when helping our clients get on the right track.

Wait

If you are in retail wait...even though consumer spending is down we see there could be a bit of a cat-and-mouse game where consumers do not see the supply scarcity they have seen over the last three years and feel compelled to look for deals as we near December 25th. The buying ramp may be very steep near the end of the year.

Secondary Markets

If the steep ramp does not happen look to get your secondary markets ready to go where you can clear inventory quickly and efficiently.

New Markets

Look for new markets. If the US consumer did not show up as you (or anyone anticipated) check in with the EU, South America, and African, and Asian markets to see if you have a compelling reason to discover a new client base.

Build a Storage Model

This is easy to do and often overlooked in supply chain management operations. Define your carrying cost for your inventory, add up your expenses (capital, storage, labor, transportation, insurance, taxes, administration, depreciation, obsolescence, and shrinkage over a 12-month period). Divide those carrying costs by your total inventory value. It is common for this % to be between 20 – 30% of the total inventory value. If you are below this range, you may hold your inventory in storage cost-effectively and arrive on the other side of the tough season ready to move forward.

With many economists agreeing volatility will be the norm for a while deal with this “peak season” as rationally as you can. You are not alone; many others are in similar spots. Use this time to make your carrying cost calculation a routine part of your inventory management practices. Know how long and at what costs you can hold and if you need to shed inventory prepare your secondary and new market options.